Frequently Asked Questions

On April 2, Belmont voters will face a choice. If we pass a Proposition 2 ½ override, we can preserve the qualities that make Belmont a great place to live. Without an override, the town will be forced to make deep cuts to public safety, our schools and other services.

Belmont’s purchasing power has sharply declined in recent years, due to inflation, rising healthcare costs, and increases in the price of materials. State-mandated expenses for special education and pension payments have also grown significantly.

State law bars towns from having a budget deficit; cuts are mandatory if expenditures exceed revenues. In the past 20 years, Belmont has implemented only one operating override (in 2015). Now is the time to pass a new one to help our community thrive for years to come.

A Guide to Proposition 2 ½ Overrides in Belmont

1. What is Proposition 2 ½?

2. What is an operating override?

3. Why does Belmont need an operating override now?

4. How will funds from a successful override be used?

5. What happens if the operating override does not pass?

6. How will the town be strengthened by an override?

7. Does Belmont receive additional revenues from new growth?

8. When property values go up, does that directly result in an increase in tax revenue for the town?

9. How do Belmont's taxes compare to other towns?

10. Is Belmont using taxpayer funds efficiently?

11. What is the town doing to reduce the tax burden?

12. When did Belmont last approve an override?

13. Did Belmont pass overrides to fund building the middle/high school, library, and skating rink?

14. How is Belmont funding current park and field restoration projects?

15. How does Belmont’s school spending compare to other communities?

16. Is enrollment in Belmont’s school district declining?

17. How will the operating override affect my taxes?

18. Are options available for residents who can’t afford the tax increases?

19. Why has my tax bill gone up more than 2 ½ percent some years?

The Campaign

20. How can I get involved?

21. How can I stay informed about the campaign?

22. Who is involved in the campaign?

23. About this FAQ

A Guide to Proposition 2 ½ Overrides in Belmont

1. What is Proposition 2 ½?

Proposition 2 ½ is a state law passed in 1980 that governs how local property taxes are raised. Under the law, towns may raise their total property taxes by up to 2 ½ percent per year, with the exception of new construction. Any increase beyond 2 ½ percent must be approved directly by a majority of town voters. Because the cost of providing the same services often increases faster than 2 ½ percent annually – especially when inflation is high – towns in Massachusetts regularly hold override votes to increase revenues to match expenses.

2. What is an operating override?

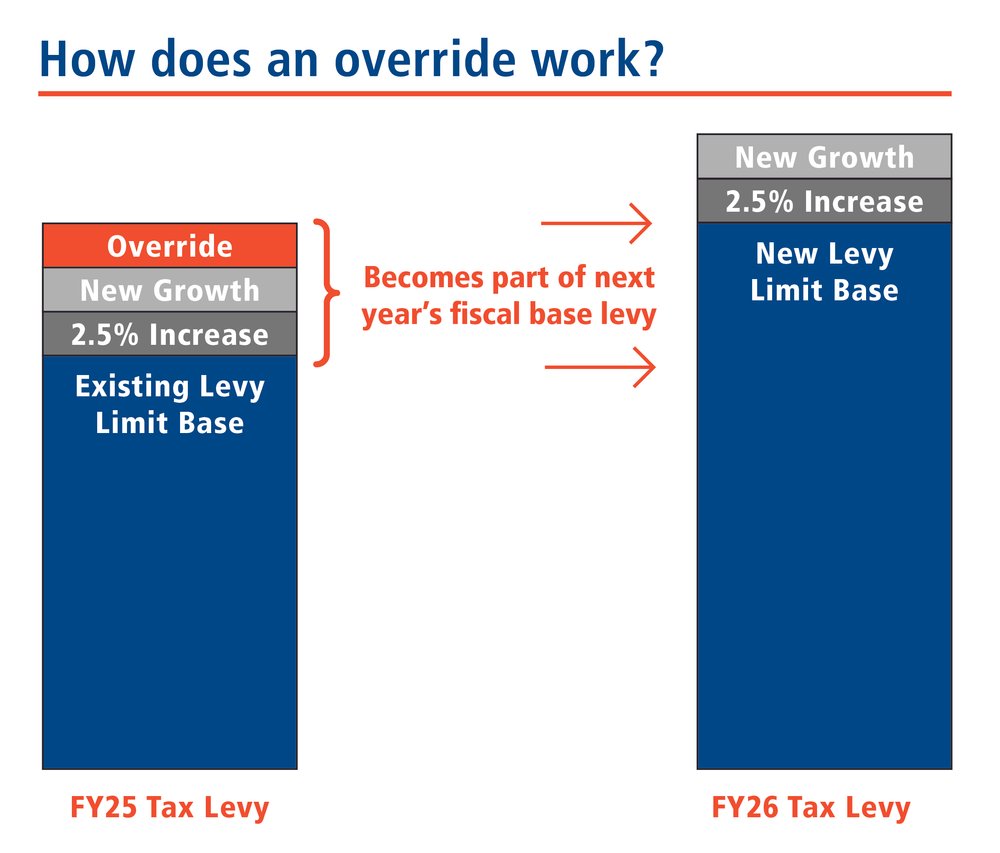

An operating override is a townwide vote that allows the town to increase the annual tax levy by more than 2 ½ percent (the limit placed on towns by the law known as Proposition 2 ½). When the Select Board asks voters to consider an operating override, the local ballot measure must specify exactly how much additional revenue is being sought.

If the override is passed, the additional amount approved is added to the tax levy to create a new baseline (see illustration below). In subsequent years, rate increases are once again limited to 2 ½ percent.

3. Why does Belmont need an operating override now?

Like many other Massachusetts towns, in recent years Belmont has not been able to maintain level services within the limits set by Proposition 2 ½. There are several reasons for this, including:

- High inflation in recent years has meant that the town’s purchasing power has steadily declined.

- Many hard costs are rising faster than inflation.

- Tight employment markets and rising healthcare costs for town employees have continued.

- Significant increases in state-mandated expenses for special education and pension payments have put pressure on the budget.

- Belmont’s property taxes are 95 percent residential and 5 percent commercial. The town’s consistently small commercial tax base has limited its ability to offset the cost of providing services.

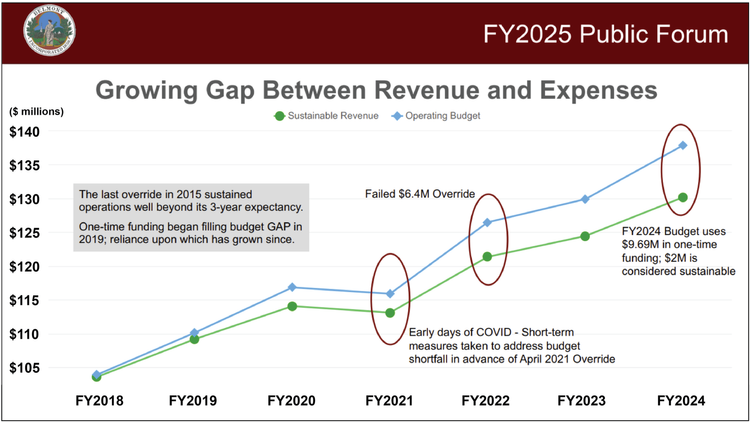

During a public forum on September 28, 2023, the Select Board presented a chart on the gap between revenues and expenses that has developed over the last six years.

A Proposition 2 ½ override will maintain the qualities that make Belmont a great place to live. Without an override, the town will be forced to accept devastating cuts to public safety, the senior center, trash and recycling collection, the library, our schools, and a range of other services. This decision could not be more consequential.

4. How will funds from a successful override be used?

A successful override will enable the town to continue funding all of the services that residents currently receive, from trash pickup and public safety to operation of the schools, senior center, library and other facilities. In addition, the override will allow strategic investments to:

- Repair sidewalks,

- Improve math and reading instruction, and

- Implement in-house special education programming.

- Improving sidewalk safety,

- Improving core instruction to ensure learning challenges are addressed as early as possible, both improving outcomes and avoiding the need for more intensive interventions later, and

- Implementing special education programming to allow more students to succeed in Belmont and reduce reliance on specialized programs outside of the district.

5. What happens if the override does not pass?

If the override doesn’t pass, the town will be forced to cut critical services, including:

Public Safety & Emergency Response

- Lay off 8 firefighters/EMTs and likely close Leonard Street fire station

Trash & Recycling

- Eliminate town-funded collection (new fees for pay-as-you-throw)

Library

- Reduce library hours and services, lose access to books from other libraries (due to likely loss of Massachusetts Board of Library Commissioners accreditation)

Seniors

- Eliminate many senior services (due to 24% budget reduction)

Schools

- Eliminate 50 FTEs, including 22 teachers

- Eliminate theater programs, middle and high school extracurricular clubs & activities, all varsity, JV & freshman sports teams

- Close the Burbank Elementary School

- Eliminate busing for 85% of riders (approximately 668 students)

- Lose opportunity to improve math & reading instruction and implement new special education programming

6. How will the town be strengthened by an override?

An override will benefit all residents by making our community a desirable place to live. The quality of our schools and other services underlies the real estate values of all homes in town. Without an override, the town will be forced to implement deep cuts to a wide range of services. Cuts of this magnitude will permanently change Belmont for the worse and likely reduce home values in our community.

7. Does Belmont receive additional revenues from new growth?

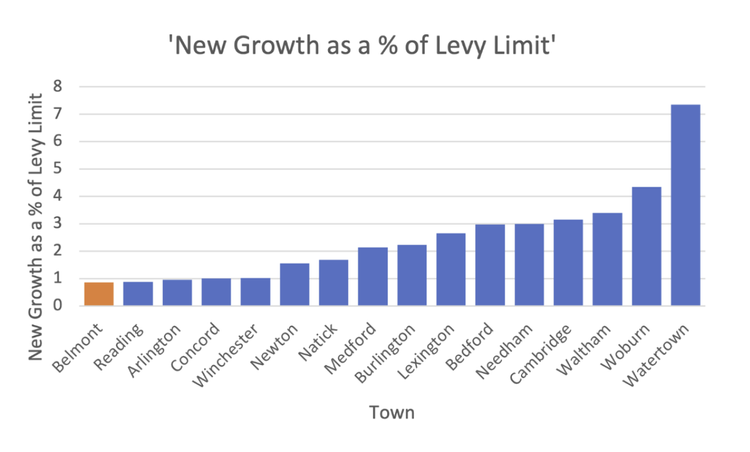

Yes, but Belmont has relatively little new growth compared to many other towns. For many communities, new growth is an important revenue source. Due to space constraints and zoning regulations, Belmont’s new growth remains low and falls well short of the state-wide average.

New Growth for FY 24

Source: MA Department of Revenue

8. When property values go up, does that directly result in an increase in tax revenue for the town?

No. The total amount in property taxes that the town collects can increase by only 2 ½ percent each year, excluding new growth. When property values increase by more than 2½ percent in a single year, as they recently have in Belmont, the tax rate has to be adjusted so the total amount of taxes assessed town-wide only increases 2 ½ percent. As a result, the tax rate on properties can decline. In recent years, the tax rate per $1,000 of assessed value in Belmont has decreased from $12.15 in FY18 to $10.56 for FY24.

9. How do Belmont's taxes compare to other towns?

Currently, Belmont’s residential tax rate is $10.56 per $1,000 of assessed value. This puts us in the lowest 25% of tax rates across all cities and towns in Massachusetts. However, Belmont's home values are higher than those of our peer communities.

Belmont's low tax rate and high property values produce residential property tax bills that are comparable to our peer communities (see chart below of Residential Property Tax Bill Per Household).

This chart shows the average residential property tax bill per household for all types of residences in Belmont (single-family and multi-family) as well as for peer communities. You may have seen charts elsewhere showing the Average Single-Family Tax Bill as a percent of per capita income. We're not using this chart because:

- Fewer than half of homes in Belmont are single-family, and they represent the most valuable residences in town.

- Showing the average single-family home value as a percent of per capita income is comparing only our most valuable properties (including mansions) against the incomes of people who live in all types of properties (including condos and apartments).

The chart above takes the total amount of tax collected from residential properties (in FY24) and divides it by the number of households in town (from the most recent 2020 US census). This paints the most accurate picture of Belmont's residential taxes and how they compare to those of other towns.

10. Is Belmont using taxpayer funds efficiently?

Yes, Belmont is efficient in how it uses tax dollars. For this reason, Moody’s Investor Service recently renewed the town’s AAA bond rating citing “stable financial operations and fiscal management.” Only a small number of towns in Massachusetts have earned this rating, which is the highest a municipality can receive.

Belmont is also frugal, spending less per resident than most of our peer communities.

In recent years, Belmont has taken additional steps to improve its financial management. In 2022, the town implemented a more effective and transparent budgeting process. And, after a town-wide vote in 2023 to switch to an appointed treasurer, Belmont was able to reorganize the treasurer’s office and implement significant cost-saving efficiencies.

11. What is the town doing to reduce the tax burden?

Belmont has stretched our last override for every dollar over nine years. The town has reduced staffing, reorganized departments, automated processes, cut spending, sold assets, and adjusted compensation and benefits. With a focus on “Smarter, Better, Faster," Belmont continues to implement efficiencies, pursue zoning reform to grow our commercial revenue, and find new ways of delivering services.

In addition, town leaders are developing a comprehensive plan for reducing Belmont’s year-over-year expense growth. Representatives from the Warrant Committee, School Committee and Select Board are currently crafting a "Compact with the Voters" that will lay out the strategies they have identified for achieving this critical goal.

12. When did Belmont last approve an override?

Over the past 20 years, Belmont has approved just one operating override in 2015.

13. Did Belmont pass overrides to fund building the middle/high school, library, and skating rink?

No. The construction of the Belmont Middle and High School, the new library, and the skating rink were each funded by a temporary property tax increase known as a debt exclusion. Debt exclusions allow the town to build a school or other building and pay for it over time (typically 30 years). By law, the temporary increase in taxes may only be used to pay back the cost of the buildings that voters approved. Once payments for a specific project are completed, the tax increase ends.

The funding for these projects did not come out of the operating budget and cannot be used to pay for the operating budget. If Belmont had never voted to build any of those buildings, the town would still need an override.

14. How is Belmont funding current park and field restoration projects?

These projects are being funded through the Community Preservation Act (CPA), a state program that provides matching funds to eligible communities for open space protection, historic preservation, affordable housing creation, and the development of outdoor recreational facilities. Belmont voted to adopt CPA in 2010 by implementing a small surcharge on property taxes, which made the town eligible for partial state matching funds. CPA funds may not be used to cover town operating costs or for any other purposes other than the approved uses listed above.

15. How does Belmont’s school spending compare to other communities?

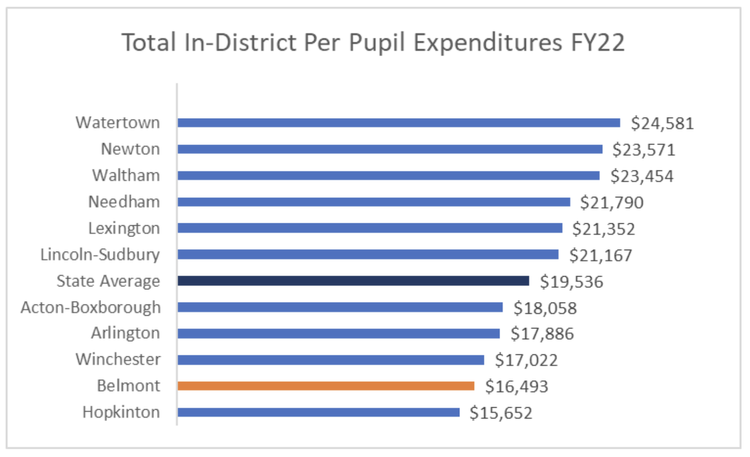

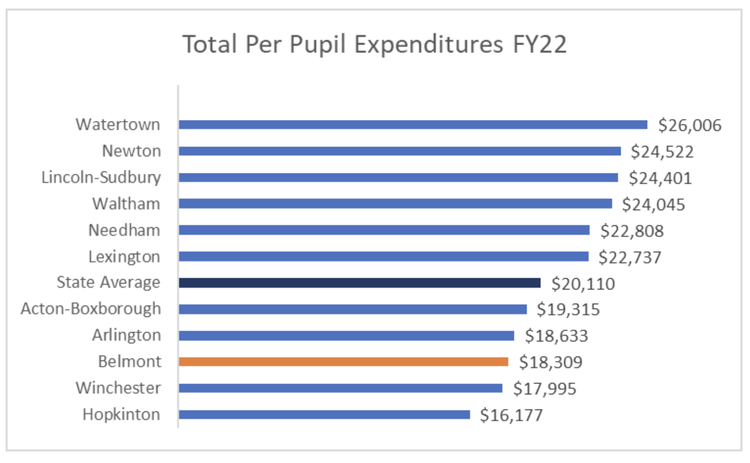

Belmont spends significantly less to educate each student than peer communities. According to the Massachusetts Department of Elementary and Secondary Education, in the 2022–2023 academic year, Belmont’s per pupil in-district spending was $16,493. This is well below the state average and most neighboring communities.

When the cost of out-of-district placements is factored in, Belmont’s per-pupil spending is slightly higher, but still well below the state average and most peer communities.

As a result of lower expenditures per pupil, Belmont has fewer teachers per 100 students than the vast majority of towns (Belmont is tied for 285th place out of 290 districts), falling well below the state average.

When compared to peer communities, an outsized portion of Belmont’s school funding goes to pay for out-of-district placements. A significant contributing factor has been a lack of funding to make strategic investments in updated curriculums, teacher training, small class sizes, and the in-district services and programs that would allow more students to succeed academically within the district.

An override would allow the school district to:

- Improve elementary math and reading instruction to address learning challenges as early as possible, and

- Implement special education programming to allow more students to succeed in Belmont and reduce reliance on specialized programs outside of the district. This would improve outcomes, keep students with their peers, and reduce costs in the long run.

16. Is enrollment in Belmont’s school district declining?

Enrollment in Belmont Public schools has increased by roughly 40% since 1994 (during that same time period, the town’s population increased by only about 10%).

After the COVID pandemic, the town’s public schools experienced a temporary decline in enrollment, but now enrollment is rising once again.

17. How will the operating override affect my taxes?

The Select Board voted unanimously to put an override of $8.4 million on the April ballot. If approved by voters, this override will add approximately $740 (or $14 per week) to the annual tax bill for a home worth $1 million.

18. Are options available for residents who can’t afford the tax increases?

Yes. Belmont offers a number of programs to help qualifying residents reduce or postpone property tax obligations. These fall into three categories:

Exemptions: The town offers a variety of exemptions to reduce property tax obligations for certain eligible taxpayers, including elderly residents, blind residents, and disabled veterans. A chart describing eligibility for these exemptions, which range in size from $175 to full exemption, is available on page 11 of Information for the Belmont Taxpayer Brochure.

Deferrals: Belmont also offers a Tax Deferral Program, which enables qualified owners to defer up to 100% of annual property taxes until the sale of the home or the death of the owner(s). In 2018, Belmont Town Meeting overwhelmingly voted to reduce the interest rate that accrued on such deferrals from 8% to 4.5% (effective FY20). Deferred taxes are paid back, with accrued interest, at the time the home is sold. Applicants must be 65 or older and meet maximum income requirements. Applications are available through the town assessor’s website.

Work-Off Program: Through the Council on Aging, Belmont also sponsors a Property Tax Work-Off Program, which allows older residents to reduce their property taxes by up to $1,500 per year by volunteering in various capacities for the town. Interested individuals should contact the Council on Aging directly for additional information at (617) 993-2970.

For more information and to apply for these programs, please see Information for the Belmont Taxpayer or visit the Town Assessor’s website.

19. Why has my tax bill gone up more than 2 ½ percent some years?

The 2 ½ percent limit applies to the total tax revenue on all existing property in town. If your property’s assessed value increased at an above-average rate, your tax bill may have gone up more than the town-wide average. If you think your assessment is too high, there is a process to appeal it. For more information, contact the Assessor’s Office at (617-489-8231).

In addition, Belmont voters have approved debt exclusions, which affect tax bills. Most recently, voters approved issuing municipal bonds to build the Belmont Middle and High School, the new library, and the skating rink. Payments for the Middle and High School debt are already included in property tax bills, and payments for the library and skating rink will be included in the January 2024 property tax bills.

The Campaign

20. How can I get involved?

You can sign up to volunteer, make a donation, and let us know you’re planning to vote yes!

21. How can I stay informed about the campaign?

Sign up here to receive campaign updates.

22. Who is involved in the campaign?

The Invest in Belmont campaign is run by volunteers from across Belmont. The campaign Chair is David Lind and the Treasurer is David Zipkin. If you’d like to get involved, please fill out our Volunteer Sign-up Form.

23. About this FAQ

We will continue to add more questions and answers to this list as more details about the override become available. If you have questions, please reach out to us at info@investInBelmont.com.